V3 Pool

What is a V3 Pool?

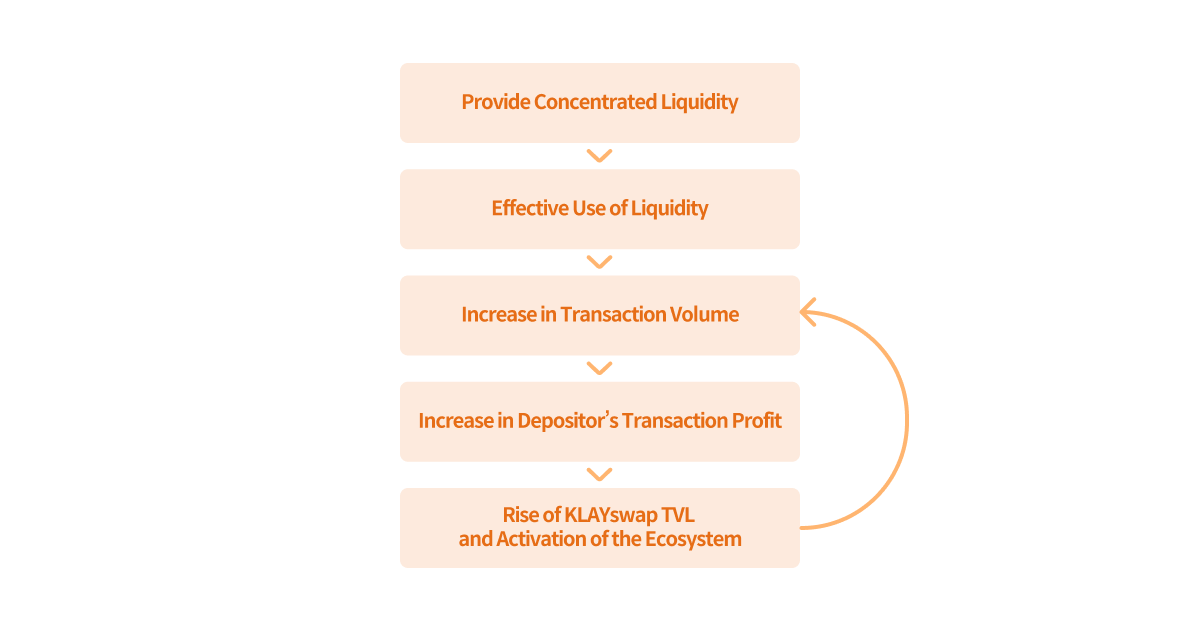

Unlike the V2 pool, which supplies assets in all price ranges (0~∞), the V3 Pool supplies assets in a specific price range. Concentrated liquidity refers to a supply of assets in a particular range, and liquidity can only be utilized within that range. KLAYswap's primary driving force is the expansion of liquidity pools. As more assets (liquidity) are supplied into liquidity pools, more transactions occur, and as more pool usage fees are distributed to liquidity providers, more liquidity and suppliers will join the KLAYswap ecosystem.

However, the existing V2 pool was built with a CPMM model (Uniswap V2) based on x ∗ y = k, which supplies assets in all price ranges. This leads to a problem of 'low liquidity efficiency', where most supplied liquidity is not utilized for trading. As a result, KLAYswap's overall trading volume and pool usage fee profit ends up declining, weakening the users' motivation to provide additional liquidity.

The V3 Pool provides liquidity at a price level where transactions frequently occur so that the created liquidity can be used for a broader range of transactions. Making a considerable fee profit will increase rewards for KLAYswap ecosystem participants and allow securing financial resources to support KSP (buyback) to be carried out more efficiently.

Features of V3 Pool

The following are the key features of KLAYswap's V3 pool.

1) Distribution of pool usage fee to Liquidity Providers (LP)

V3 pool suppliers will receive 80% of the fee profit generated in the pool. The assets supplied in V3 pools are actively used for transactions, making it possible for suppliers to generate more profit.

By distributing these pool usage fee profits to suppliers, suppliers can reduce their chance of impermanent losses in liquidity supply. Further, KSP rewards are distributed to the V3 pool according to the KSP distribution policy, and more KSP rewards are rewarded to suppliers based on active trading volume.

2) Types of V3 pools

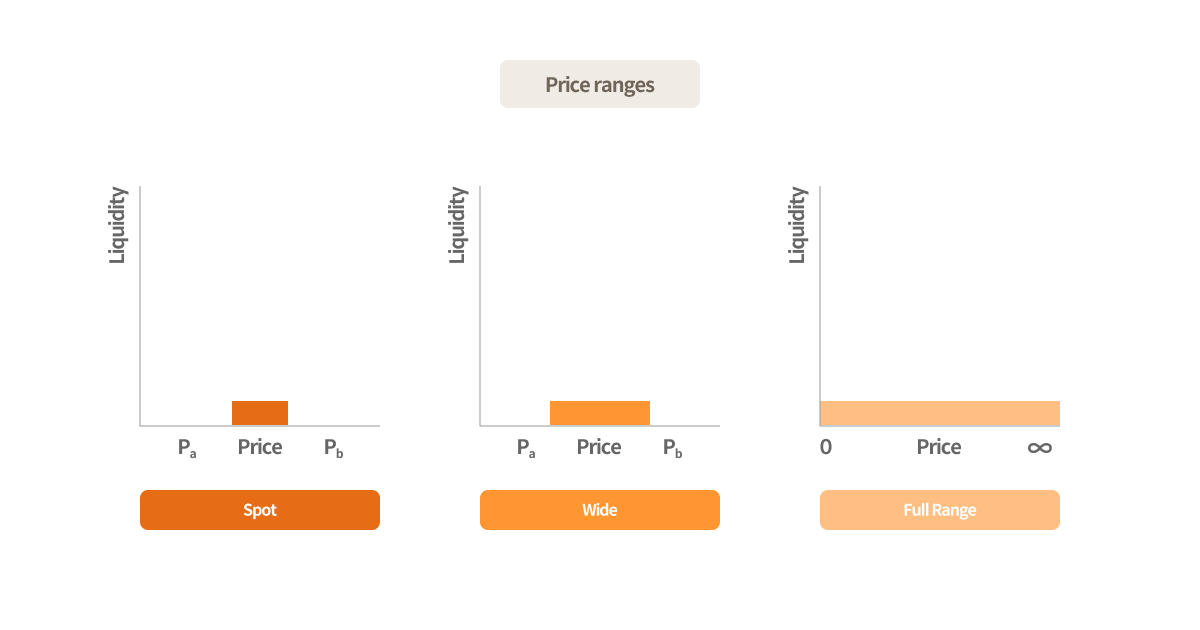

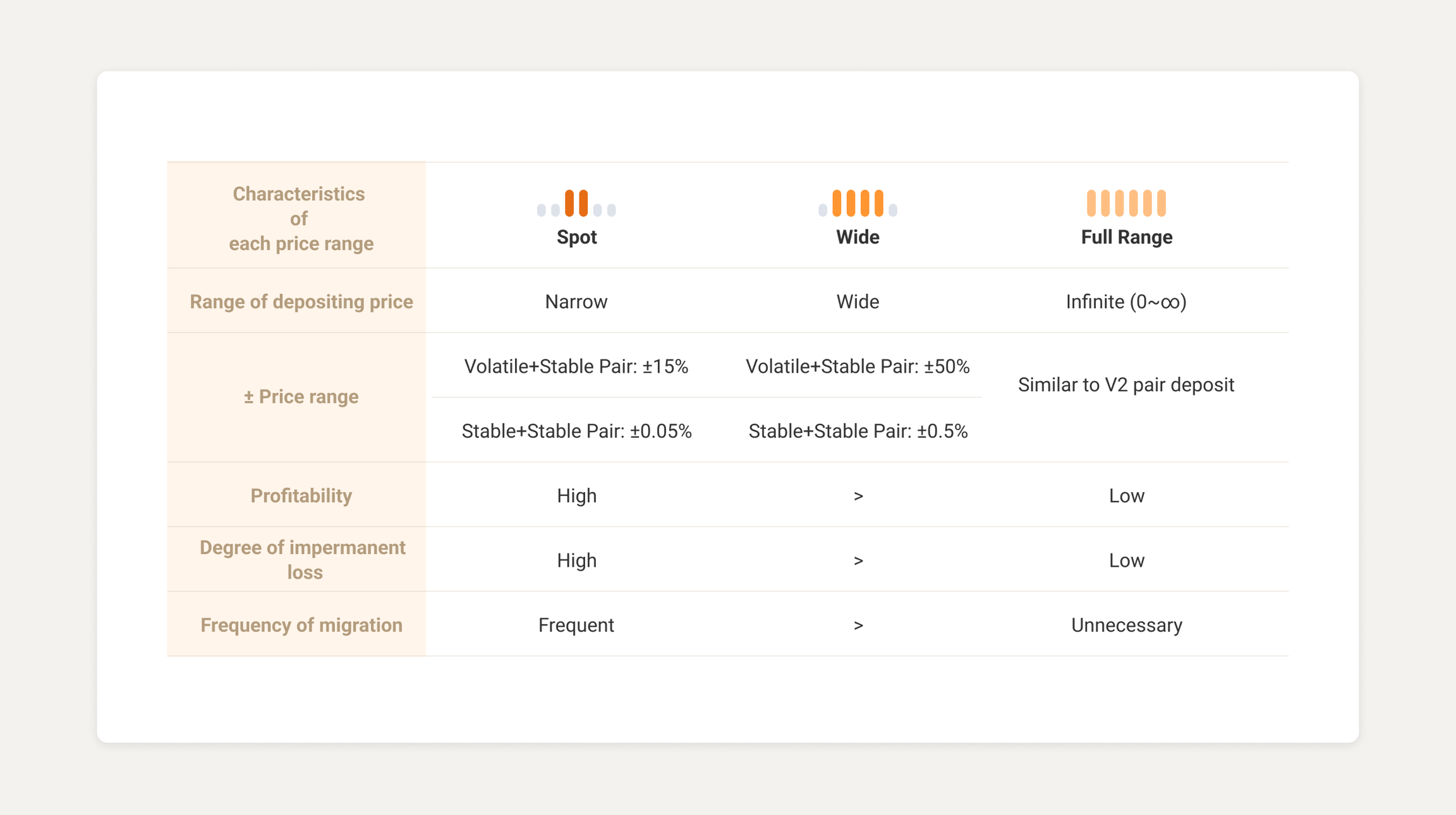

Users can customize the price range for supplies. Users can also supply quickly and conveniently by choosing one of the three price ranges (Spot, Wide, Full range) provided by KLAYswap V3 pool. Price ranges of each type range from +n% to -n%, according to a parameter previously set by a contract.

A ‘price range’ represents the range of prices within which supplied assets can be traded, and when a transaction is conducted within that range, suppliers will receive their pool usage fees. Each price range has the following characteristics.

Characteristics of Spot, Wide, and Full price ranges

Suppliers can expect a higher pool usage fee profit if the price range is narrower, as the liquidity provided by users are more likely to be used for transactions.

However, since tokens with large price fluctuations are supplied intensively in a narrow price range, it is necessary to continuously monitor the current token price to ensure that it stays within the supplied range. In such a case, the assets should be migrated to valid price ranges where the swap occurs. Furthermore, the more suppliers provide within a narrower price range, the more likely the token's price will change from the time of supply, causing the impermanent loss to increase(Please refer to Price Range Fall Out and Migration.)

Using the above method, KLAYswap's V3 pool offers suppliers with no previous experience in providing V3 liquidity the convenience and flexibility to do so. Future updates will enable suppliers to customize their price range.

3) V3 pool Migration(V3 → V3) Support

The KLAYswap V3 pool offers one-stop migration, allowing suppliers to migrate their assets with a single transaction. The detailed procedure consists of asset removal - supply in a new price range, and suppliers can migrate from the details page of the pool they provided liquidity for.

Connect Link: 2.2 V3 to V3 Migration Guide

Connect Link: 2.2 V3 to V3 Migration Policy

4) Migration From V2 Pool to V3 Pool(V2 → V3) Support

Compared to V2 pool, V3 pool provide suppliers with higher pool usage fee profit since supplied assets are more efficiently utilized for trading. Through the migration function, users already supplying assets in the V2 pool can also provide liquidity to the V3 pool. Suppliers can easily migrate from the detail page of the V2 pool. Migration supplies assets with a single transaction consisting of removing assets from the V2 pool to supplying in the V3 pool.

Connect Link: 2.2 V3 to V3 Migration Guide

Connect Link: 2.2 V3 to V3 Migration Policy

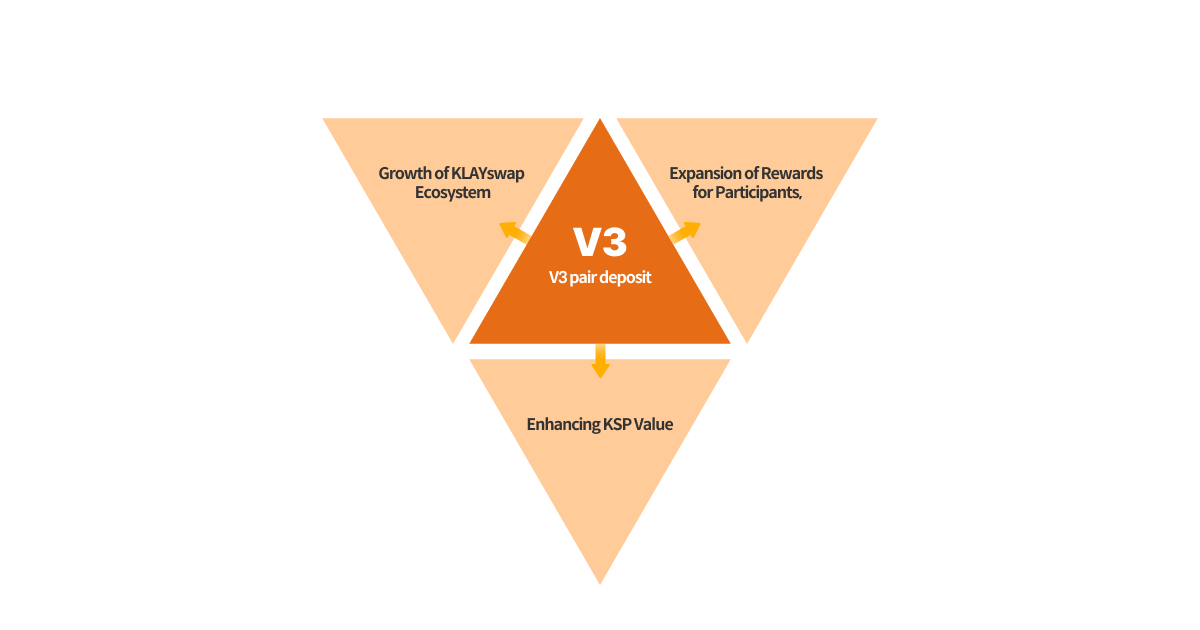

KLAYswap's Growth Through V3 Pool

KLAYswap already has the largest liquidity and ecosystem participants in the Klaytn ecosystem. And KLAYswap’s goal is to migrate liquidity and participants to V3 to improve the efficiency and dynamics of the ecosystem's liquidity.

Concentrated liquidity provides a more favorable environment for users, leading to KLAYswap doubling its existing trading volume. With this explosive growth in pool usage fees, KLAYswap will be able to enhance the value of KLAYswap, ecosystem participants, and KSP value.

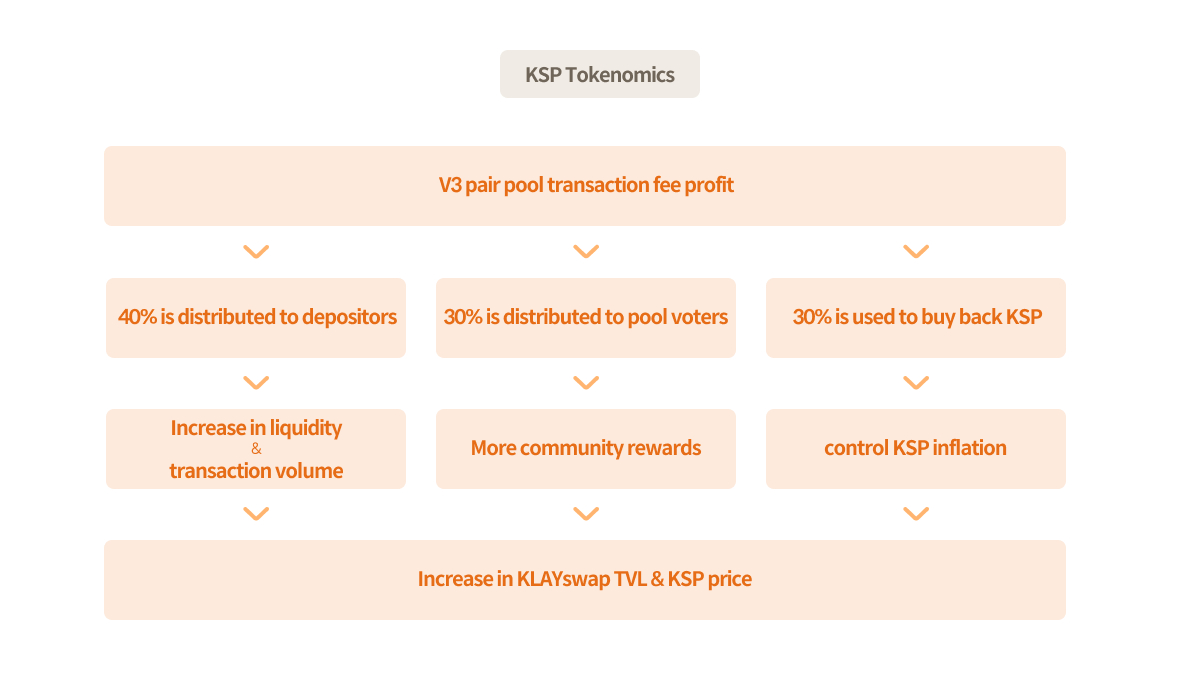

Growth of KLAYswap Ecosystem

The V3 pool distributes 80% of the pool usage fee profit to V3 pool suppliers in order to continuously fill the pool with new liquidity. As a result of such a process, KLAYswap's TVL rises, creating a virtuous cycle, which ensures abundant liquidity, and generates more profit from pool usage fees based on that high TVL.

Expansion of Rewards for Ecosystem Participants

Based on KSP Tokenomics, a V3 pool distributes 10% of the profit generated to KSP staking participants (vKSP holders) as rewards. Therefore, not only V3 pool suppliers but also KSP stakers can obtain more expanded rewards.

Enhancing KSP Value

The remaining 10% of the pool usage fee profit from the V3 pool is used to buy back KSPs. With the expansion of KSP buy-backs, inflation will be stabilized, which will increase KSP value and ultimately lead to an increase in demand for holding KSPs.

Last updated