V3 Supply Policy

V3 Supply Policy

1) Users can supply assets directly by entering the pool's exchange rate (price) that corresponds with the price range they are currently supplying.

2) Users can supply when they have two assets or even just one. In the case of two asset supplies, no swap occurs, but in the case of a single asset supply (A or B), the smart contract swaps and supplies assets at the optimal ratio based on the current pool exchange rate. If a swap is required, V2 and V3 pools are used as swap paths and transaction fees apply. Fees are based on the pool's transaction fee rate.

3) Supplies are made after swap fees are subtracted. When swapping, the larger the transaction size (quantity), the greater the effect on the exchange rate between tokens in the pool, resulting in a difference between the current price and the price applied at the time of the exchange (price impact). Multiple runs in small quantities can reduce the impact.

4) Depending on the transaction size, there may be a price difference (Price impact) at the time of exchange, so the expected exchange rate at the time of supply may not match the exchange rate. For this reason, suppliers are only made within the transaction range (Slippage) set at the time of the swap, and if the range is exceeded, the supply transaction may be reverted (Revert). Proceed with the supply after checking all the information on estimated returns at the bottom.

5) After-supply changes in asset composition

When assets are supplied in a specific price range, their composition ratio and value may change. Even when users hold two token positions at the time of deposit, if the current trading price of the token is out of the price range supplied, users' supplies will be converted to a position holding one asset with a lower value.

Suppose a user supplies assets in the price range of 1 ETH = 1,000 USDC to 1 ETH = 3,000 USDC in the ETH/USDC pair, and the ETH price drops below 1,000; in that case, their assets are converted into ETH tokens. In contrast, users' supplies will only be held in USDC tokens if ETH prices rise above 3,000 USDC.

Therefore, the user may receive (remove) assets with a different asset composition than at the time of the initial supply, depending on the current token price.

6) No Rewards when the pool is out of range.

In a V3 pool, assets are supplied in a specific price range where a transaction is expected to occur, and pool usage fees are distributed when the asset (liquidity) is actually traded. Therefore, if the current token trading price is out of the user-supplied price range, the rewards typically distributed in the pool will not be distributed. To obtain continuous compensation, suppliers must check the pool status (in range, caution, out of range) to see if a transaction occurs within the price range they supplied or migrate or remove the asset and re-supply it in the valid price range.

7) V3 pools, which intensively supply liquidity in a specific price range, may result in greater impermanent losses than V2 pools. If token prices fluctuate greatly, supplying within a narrow price range may result in significant impermanent losses. For this reason, suppliers should consider the possibility of impermanent loss and prepare for token price fluctuations before supplying their assets in the V3 pools.

Impermanent Loss: In this situation, the value of a token supplied on a DEX decreases compared to just holding it in a wallet. Impermanent loss occurs when the ratio of users' assets changes depending on the token's price fluctuation.

8) V3 pool rewards (pool usage fees, KSP, and airdrop tokens) can be claimed directly from the detail page.

Rate of Return, Expected Returns

1) APR (%)

All rates of return (%) fluctuate according to real-time conditions, such as pool usage fees for each pool, token prices, stakes and concentration levels of users, and the active status of deposited assets.

2) Pool usage fee rate (%)

*All examples of pool usage fee profit were based on the assumption that 100% of the pool usage fees generated from the V3 pool are distributed to liquidity providers (LPs, depositors). Therefore, distribution rates for liquidity providers may vary depending on governance.

<Policy on the Distribution of Pool Usasge Fee Profit>

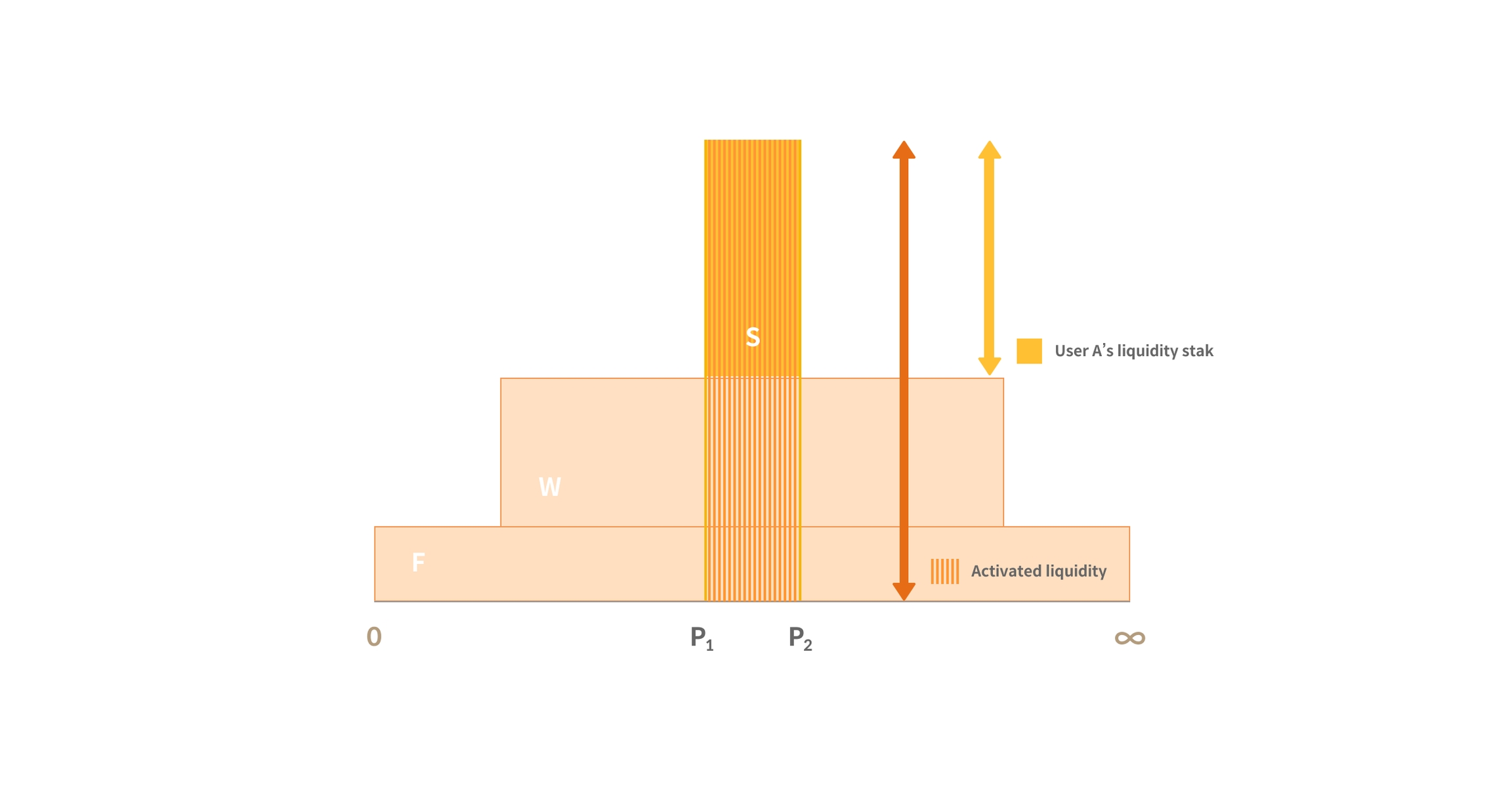

* Distribution Fee = Pool usage fee * (User’s liquidity(A)/ Utilized liquidity(T))

Pool usage profit is distributed when a transaction occurs within the supplied price range and according to the percentage of the user's share of the amount of liquidity including the tick in which the transaction occurred compared to the total amount of active liquidity including containing the tick at which the transaction occurred. (Pool usage fee distributed per transaction occurrence point)

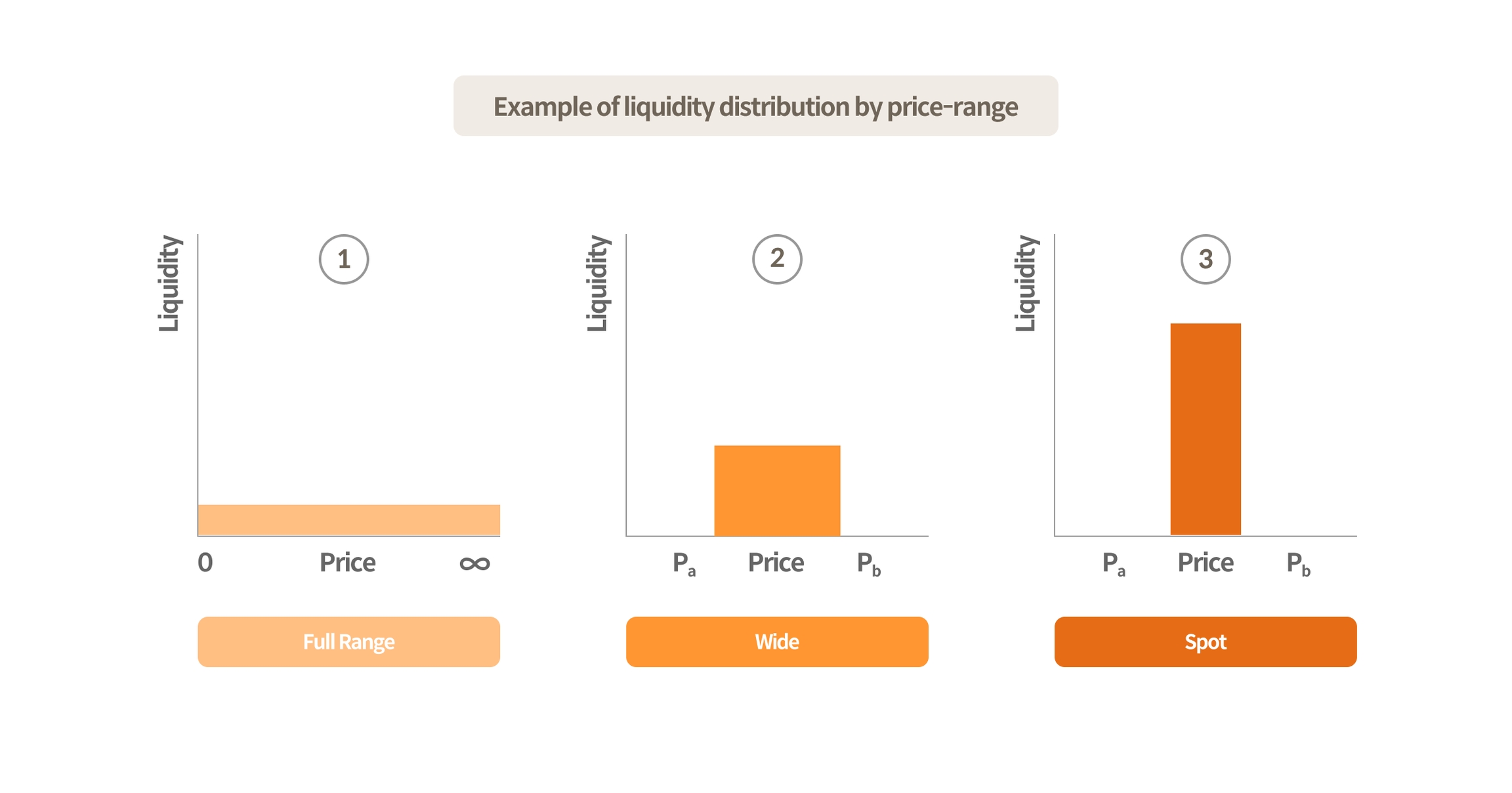

Users will have a higher liquidity stake if they deposit the same amount of assets at a narrower price range.

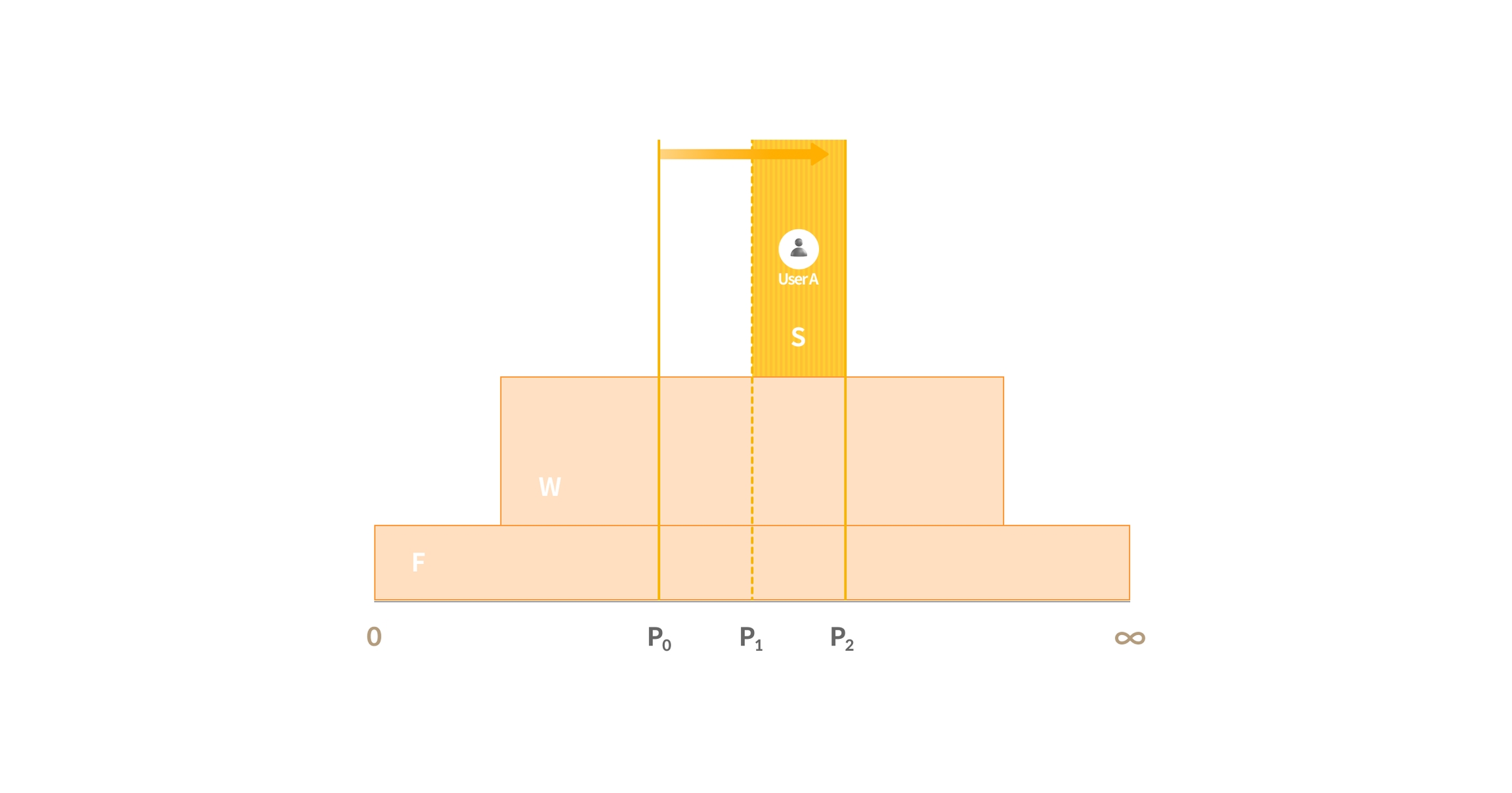

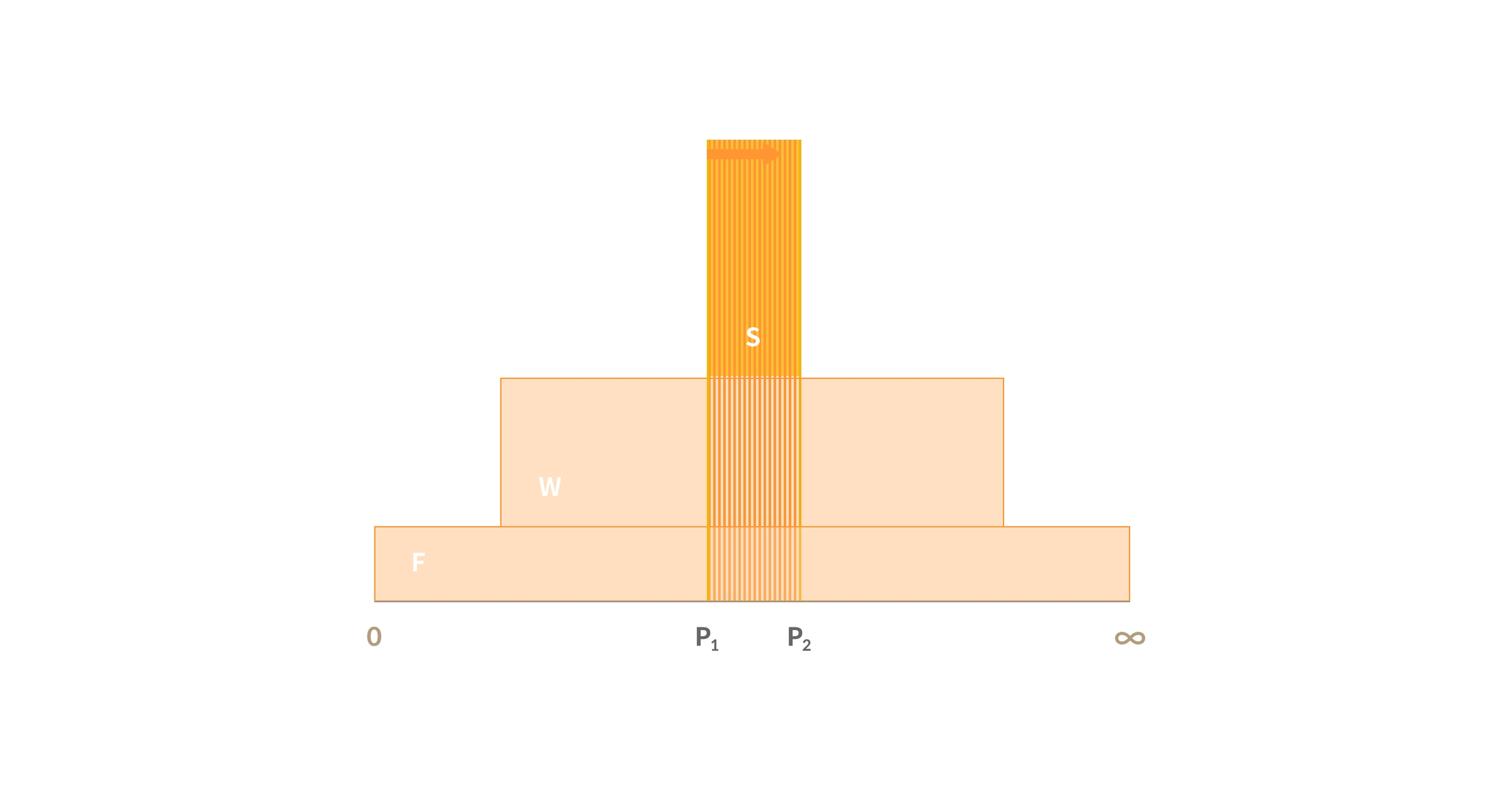

Let’s say a $1,000 asset is supplied in Full Range. In that case, as shown in Figure ①, the asset will be equally supplied in the entire price range (0~∞). However, when the asset is supplied in a narrower price range (Pa~Pb), as shown in Figures ② and ③, suppliers can enjoy the effect of higher liquidity supply even with the same amount of asset.

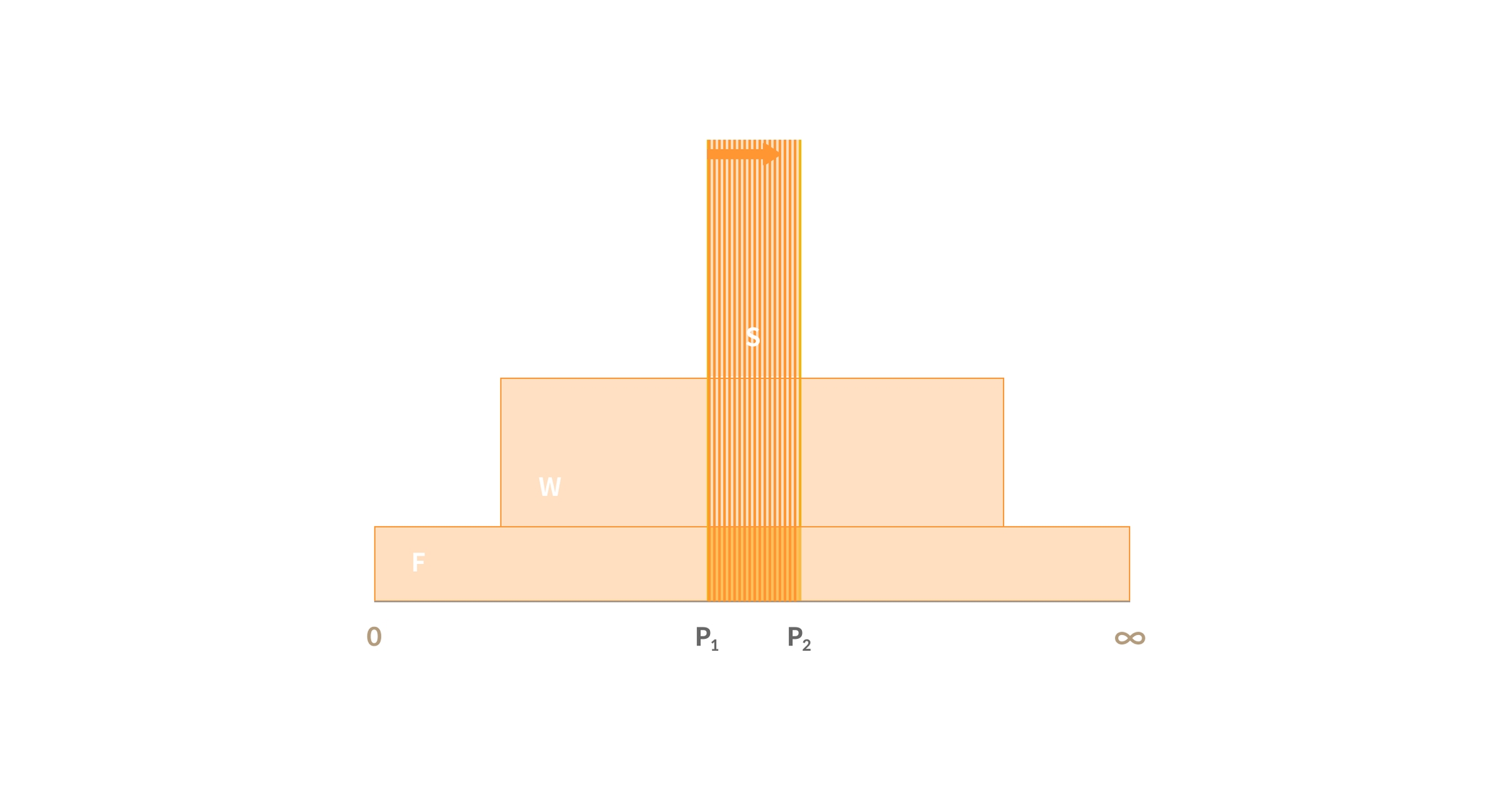

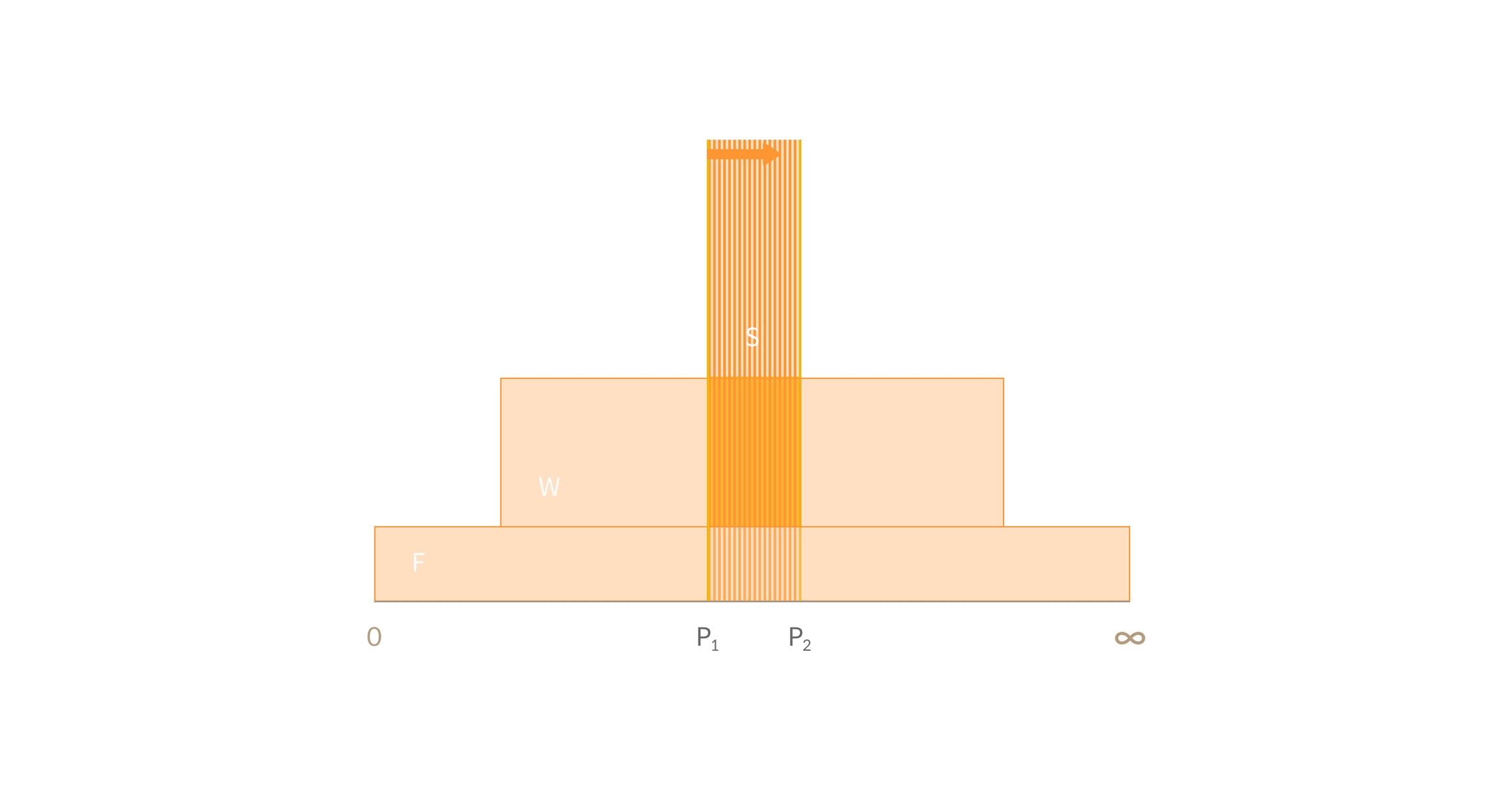

Assume that the assets are supplied into a USDT-DAI pool in only the three types of ranges mentioned above, the figure below shows their spread of liquidity.

If the token price changes from P0 to P2 due to a transaction within the pool, User A's assets will not be used in the P0 to P1 range. Instead, user A's liquidity will be used for trading in the P1 to P2 range. The share ratio of user A in the active trading liquidity in the P1 to P2 range is (user's liquidity (A)/activated liquidity (T).

Therefore, when the trading volume and scale of liquidity in the P1-P2 section is as follows, user A earns the following amount of fee:

USDT-DAI pool transaction fee rate: 0.06%

Swap Volume: $100

User A’s liquidity in the P1 to P2 range (A): $ 1,000

Total liquidity in the P1 to P2 range (B): $ 100,000

A’s pool usage fee profit = ($100*0.0006)*(1,000/100,000)= $0.0006

<Estimated Pool usage Fee Rate APR Calculation>

Calculated and displayed is the expected annual return when pool usage fees from a specific pair of V3 pools are distributed to currently active liquidity.

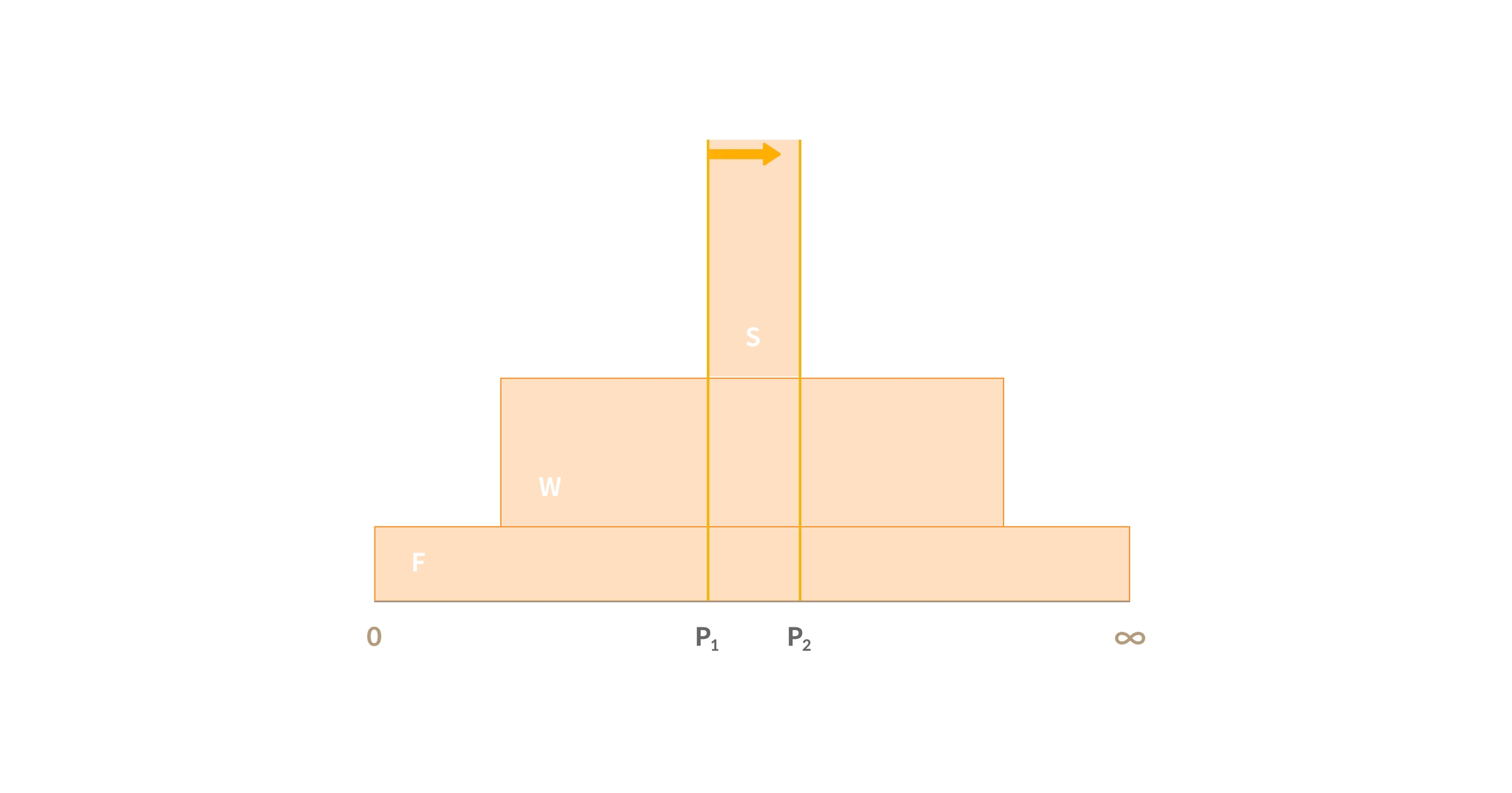

Suppose assets are supplied in USDT-DAI pools according to price range type (Spot, Wide, Full):

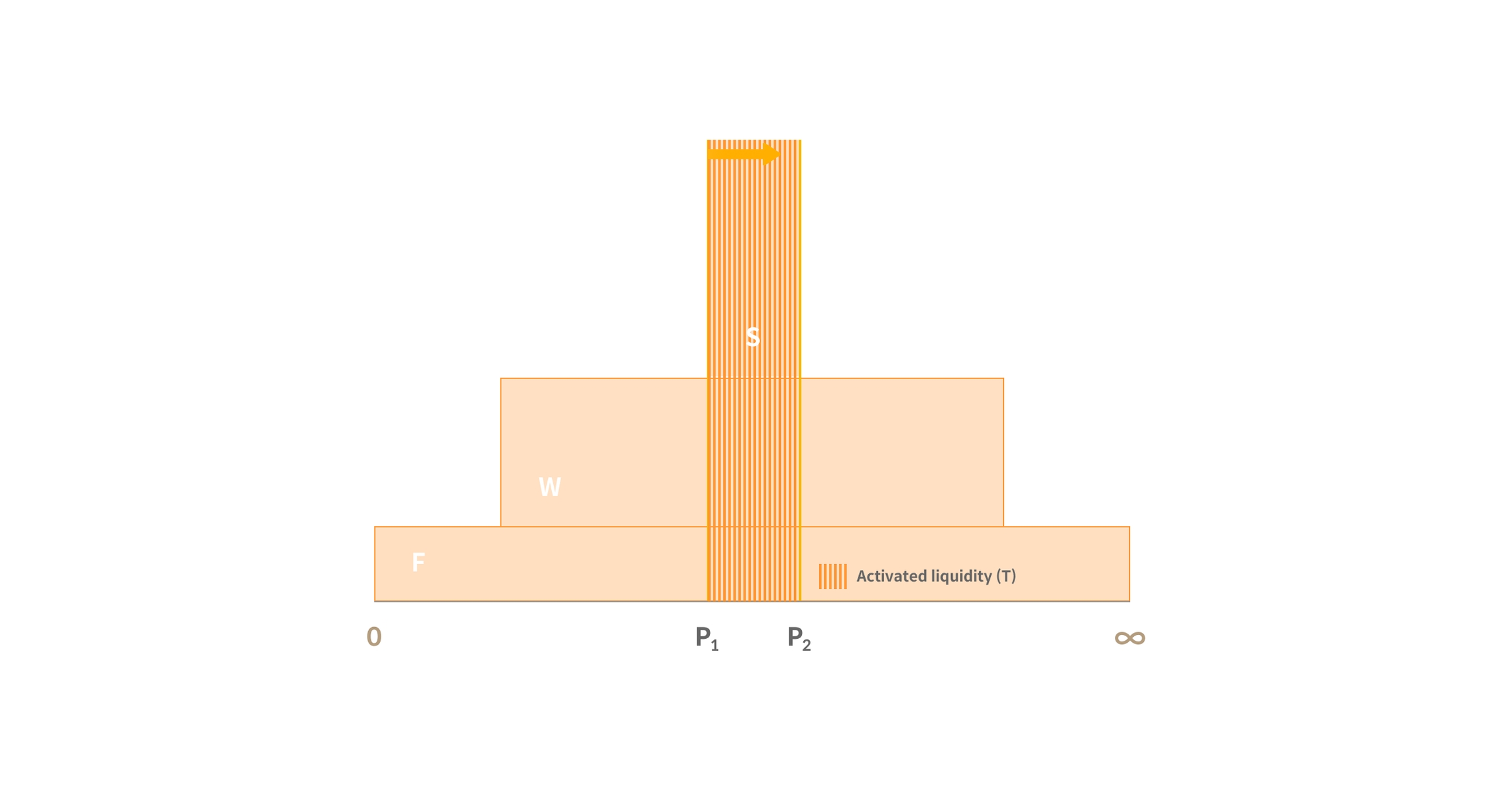

If token price is converted from P1 to P2, activated liquidity(T) in the pool is as follows:

Assuming the trade volume is between the P1 and P2 range and the liquidity size (Spot, Wide, Full range) of each price range is as follows, the expected return will be calculated as follows.

USDT-DAI Pool Fee Rate : 0.06%

Latest 24 Hour Volume: $1,000

Total liquidity of the USDT-DAI pool’s P1 to P2 range (T) : $ 100,000

Liquidity supplied when depositing in Spot range (S) : $ 27,000

Liquidity supplied when deposing in Wide range (W) : $ 4,650

Liquidity supplied when depositing in Full range (F) : $ 10

* Spot Estimated Transaction Fee APR

= Pool usa fee for the last 24 hours *(Activated Spot Liquidity (S)/ Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($27,000/$100,000)*100*365 = 5,913% annually

* Wide Estimated Transaction Fee APR

= Pool fee for the last 24 hours * (Activated Wide Liquidity(W)/Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($4,650/$100,000)*100*365 = 1,018% annually

* Full range Estimated Pool usage fee APR

= Pool fee for the last 24 hours * (Activated Full range Liquidity(F)/Total Activated Liquidity(T))*100*365

= $1,000*0.0006*($10/$100,000)*100*365 = 2.19% annually

3) KSP Distribution APR (%)

<Calculation of the pool's daily KSP distribution>

A V3 pool's daily KSP distribution amount is determined as per the V2 pool's daily KSP distribution policy. The daily distribution amount is determined using the final KSP distribution rate calculated using KSP buyback quantity. (View detailed KSP distribution policy)

<Calculation of estimated KSP distribution APR>

Calculated and displayed is the expected annual return when the daily KSP distribution quantity distributed in the V3 pool is distributed in currently active liquidity. KSP reward APR can also be calculated for each price range type (Spot, Wide, Full range):

* Spot/Wide/Full range type’s estimated KSP distribution APR

= Daily distribution amount of KSP * KSP price * (Each type of activated liquidity/Total Activated Liquidity)*100*365

4) Token airdrop APR

Calculated and displayed is the expected annual return when the daily airdrop token quantity distributed in the V3 pool is distributed in currently active liquidity. The airdrop return rate calculation is the same as the 4) KSP Reward APR.

* Spot/Wide/Full range type’s estimated air drop APR

= Daily token distribution quantity * Token price * (Each type of activated liquidity/Total Activated Liquidity)*100*365

5) KSP, airdrop token distribution

Following the governance policy, KSP, and airdrop tokens are distributed in real-time (based on Klaytn's block creation time) to the current active liquidity, so even if the assets were supplied within the active liquidity range the previous day, users might not receive rewards if the liquidity range isn't active at the time of distribution. Therefore, users must constantly check that their assets are within the active range. When the token price falls out of range (out of range state), the asset must be migrated or re-supplied after removing to earn rewards. Check out the migration guide.

6) All displayed information is a real-time estimate; therefore, information may change.

Last updated